Resecurity identified the emergence of adversarial mobile Android-based Antidetect Tooling for Mobile OS-Based Fraud.

Resecurity has identified the emergence of adversarial mobile Android-based tools (called “mobile anti-detects”), like Enclave and McFly, as a new frontier in fraud tradecraft evolution. These tools are used by criminals involved in online-banking theft to impersonate compromised account holders and bypass anti-fraud controls by leveraging mobile client. It’s crucial for fraud prevention teams to stay updated with these trends and implement robust security measures.

The tools cost between $700-$1000 and are currently designed for Android-based devices. The authors behind both tools recommend using OnePlus devices to deploy mobile anti-detect or may ship ready-to-use devices with pre-configured packages.

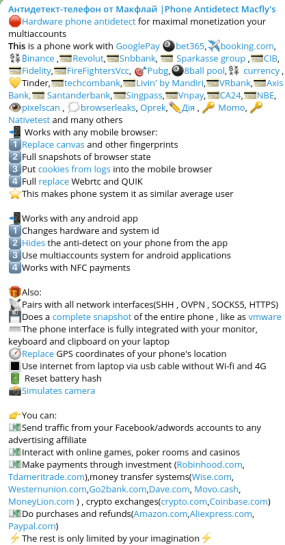

Both tools contain software allowing for device firmware upgrades and customized features such as fingerprint impersonation, GPS spoofing, and network anonymization. In addition, they come with a version of Magisk Delta from HuskyDG, a popular tool for rooting and customizing Android phones by installing modules containing the “magiskhide” module. However, it’s important to note that regulations in different areas require financial applications to have safeguards that prevent installation and execution on “rooted” devices. Still, some malicious actors continue to find ways to bypass these controls.

Mobile devices, particularly those running on Android, are now being exploited by cybercriminals. These individuals use antidetect browsers to mimic a legitimate user’s device fingerprint while using stolen login credentials. By doing this, they can access a victim’s online accounts, like a bank, using their username, password, device fingerprint, MFA token, and a local IP address close to their physical location. Antidetect software can be installed on a cybercriminal’s device or delivered through malware or pirated apps.

In a recent development, the author of the MacFly antidetect tool provided a video interview. This interview, along with the author’s ongoing discussions on their Telegram channel https://t.me/antidetect_phone/579, offers a unique insight into the mindset and technical capabilities of those who create and distribute such sophisticated tools. It underscores the need for continuous vigilance and proactive measures in cybersecurity. The author’s willingness to openly discuss their creation, even on public platforms like Telegram, highlights the audacity of cybercriminals and the constant evolution of threats in the digital landscape. This serves as a stark reminder of the importance of staying ahead of these threats and continuously updating our security measures to protect against such advanced tools

Newly discovered antidetects on the Dark Web have been found to manipulate mobile device fingerprints, software, and network parameters which are usually examined by anti-fraud systems, according to Resecurity’s latest research. The findings are alarming.

This report from Resecurity includes a comprehensive list of the top PC-based antidetect kits, such as AntBrowser, Lalicat, Aezakmi, ClonBrowser, MultiLogin, Sphere, GoLogin, Incognition, VMMask, Dolphin{anty}, VMLogin, IndigoBrowser, SessionBox, Octo Browser, MoreLogin, Undetectable, LinkenSphere, and Kameleo. Some of these kits now also offer mobile versions or dedicated mobile applications. It should be noted that mobile-based antidetects are significantly more expensive than their PC-based counterparts due to higher demand from cybercriminals.

Resecurity experts recommend financial institutions to perform fraud prevention efficiency testing and acquisition of such tools in order to stay up to date in light of increasing targeting on mobile applications and payment services by fraudsters.

Follow me on Twitter: @securityaffairs and Facebook and Mastodon

(SecurityAffairs – hacking, Antidetect Tooling)

The post Cybercriminals Evolve Antidetect Tooling for Mobile OS-Based Fraud appeared first on Security Affairs.